Easy Solutions Enterprises LLC DBA SUPERIOR TAXES

About

At Easy Solutions Enterprises, we pride ourselves on our high-quality advice. With over 14 years of experience in the tax field, we have helped numerous individuals and businesses navigate the complex world of tax obligations.

We are dedicated to providing personalized and reliable tax compliance and advisory services. Our team of highly trained and experienced tax professionals is committed to helping our clients navigate the complex world of tax obligations, maximizing their benefits and minimizing their tax burden.

Our focus is on providing comprehensive and strategic solutions for individuals and businesses, tailored to each client’s financial needs and goals. Whether you are seeking tax advice for your personal tax return, need help with your business accounting or require assistance with tax audits, our team is here to help.

Our services

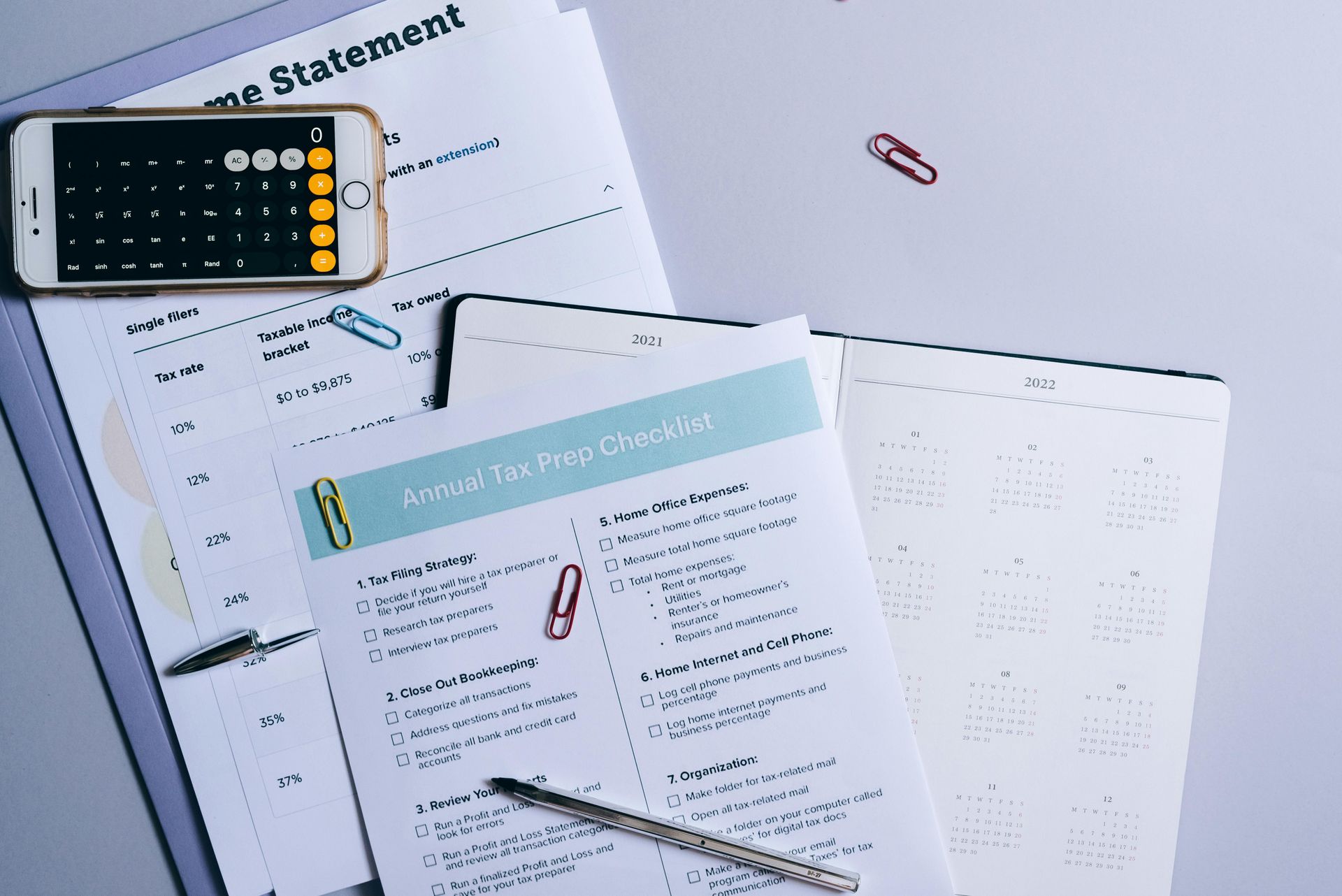

Bookkeeping Services

Accurate & Up-to-Date Financial Records

We maintain precise, organized records of your daily transactions—including income, expenses, receipts, and invoices—so you always have a clear snapshot of your financial health.

Bank & Credit Card Reconciliation

Each month, we reconcile your accounts to ensure your books match your bank and credit card statements—minimizing errors and preventing fraud .

Accounts Payable & Receivable

Keep on top of what you owe and what you're owed. We manage invoices, reminders, payments, and receipts so your cash flow remains smooth.

Financial Statement Preparation

Gain clarity and insight with expertly crafted Profit & Loss statements, Balance Sheets, and Cash Flow Reports—ready for tax time or business planning.

Monthly Close Services

Each month, we close your books neatly—review your numbers, identify trends, and ensure your records are fully updated

Optional Add‑on Services

Invoicing & Bill Pay: We’ll generate and send invoices, and manage vendor payments.

Payroll Support: Streamline payroll processing, tax withholdings, direct deposits, and reporting.

Catch-Up Bookkeeping: Fell behind? We’ll get your books current, regardless of how far off they are.

Tax Preparation Services

1. Comprehensive Tax Filing

We handle your individual, business, partnership, S‑Corp, and C‑Corp filings, ensuring every required federal and state return is accurately completed and submitted—either in office, remotely, or via drop-off/pick-up options.

2. Expert Tax Planning & Strategy

Our seasoned tax professionals (CPAs, Enrolled Agents, and licensed preparers) stay ahead of ever‑changing tax laws. We proactively identify deductions, credits, and opportunities tailored to your financial situation—helping you minimize liabilities and maximize savings.

3. E‑Filing with Wholesale Assurance

We electronically file returns through the IRS e-file system for fast confirmation and reduced errors. For eligible clients, we also utilize the IRS Free File program—offering low- to no-cost filing solutions when applicable.

4. Year‑Round Support & Audit Assistance

Tax season doesn’t stop in April. We provide year‑round support, including quarterly estimated tax projections, tax check-ins, and updates on regulation changes. In the unlikely event of an IRS notice or audit, we’ll represent you and guide you through the process .

5. Time Savings & Error Reduction

By outsourcing your tax prep, you save valuable time and minimize the risk of costly mistakes. Our professionals ensure all forms are precise, compliant, and optimized—giving you peace of mind.

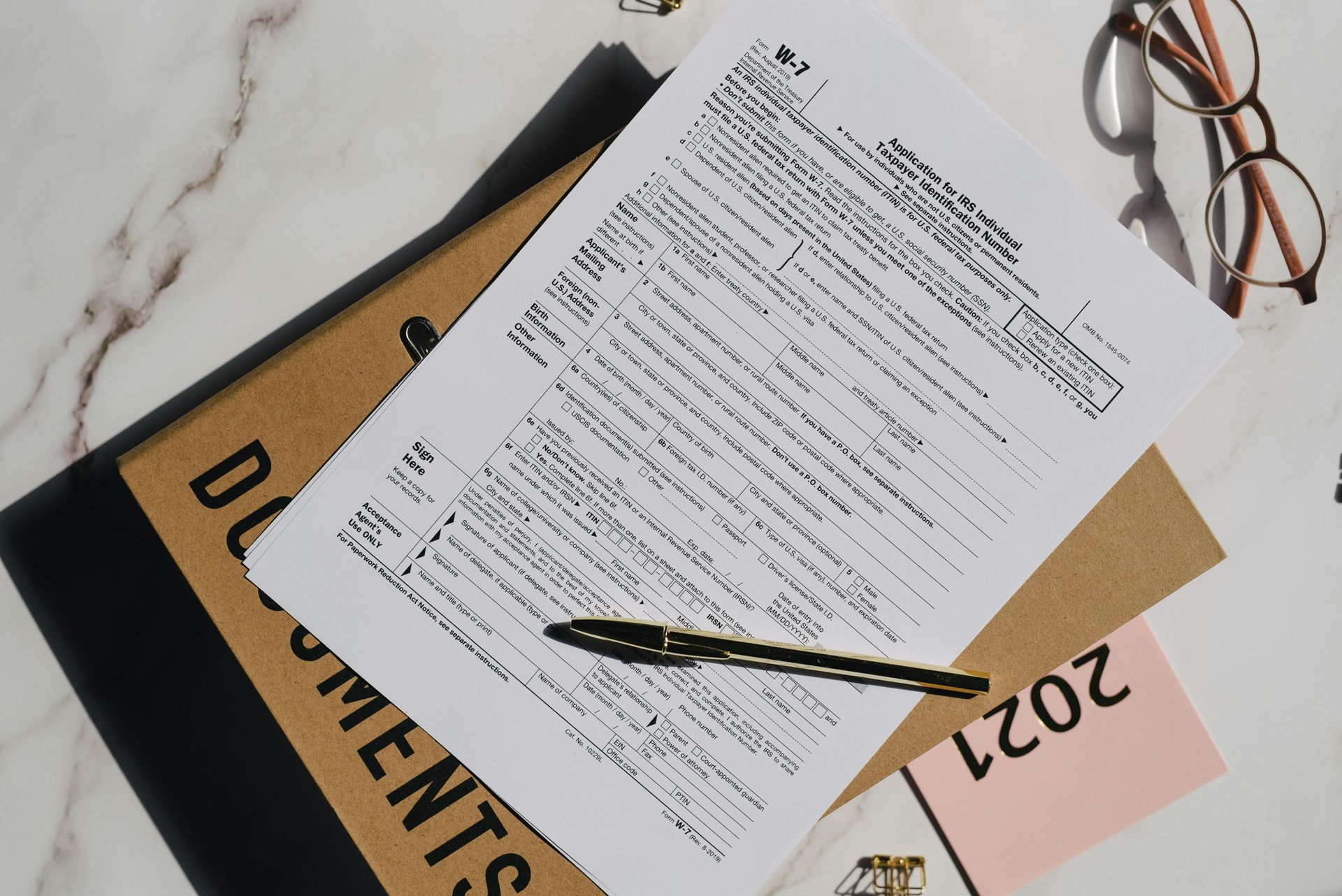

ITIN Application Services

We assist individuals in obtaining an Individual Taxpayer Identification Number (ITIN) by guiding them through the full application process:

- Form W‑7 Completion – Help accurately fill out the IRS Form W‑7 based on your personal situation.

- Document Review & Verification – Review your original documents (e.g., passport, birth certificate, visa) to ensure they meet IRS requirements.

- Application Packet Preparation – Compile your federal tax return (if required) with Form W‑7 and supporting documents into one package.

- Submission & Tracking – Submit the packet to the IRS and monitor the application status. We can also respond to IRS follow-up inquiries.

- Estimated Timelines – Processing time through a CAA is usually faster—about 3–6 weeks—compared to mailing originals, which can take 8–12 weeks or more.